While this can lead to higher returns, it also increases the company’s financial risk. Conversely, a low D/E ratio suggests that a company has ample shareholders’ equity, reducing the need to rely on debt for its operational needs. This indicates that the company is primarily financed through its own resources, reflecting strong financial stability and a lower risk profile. The D/E ratio can be classified as a leverage ratio (or gearing ratio) that shows the relative amount of debt a company has.

Investor Services

Over this period, their debt has increased from about $6.4 billion to $12.5 billion (2). It’s also important to note that interest rate trends over time affect borrowing decisions, as low rates make debt financing more attractive. However, if that cash flow were to falter, Restoration Hardware may struggle to pay its debt. For companies that aren’t growing or are in financial distress, the D/E ratio can be written into debt covenants when the company borrows money, limiting the amount of debt issued. Investors can use the D/E ratio as a risk assessment tool since a higher D/E ratio means a company relies more on debt to keep going. Utilities and financial services typically have the highest D/E ratios, while service industries have the lowest.

Q. Can I use the debt to equity ratio for personal finance analysis?

When interpreting the D/E ratio, you always need to put it in context by examining the ratios of competitors and assessing a company’s cash flow trends. Additional factors to take into consideration include a company’s access to capital and why they may want to use debt versus equity for financing, such as for tax incentives. Restoration Hardware’s cash flow from operating activities has consistently grown over the past three years, suggesting the debt is being put to work and is driving results. Additionally, the growing cash flow indicates that the company will be able to service its debt level. Put another way, if a company was liquidated and all of its debts were paid off, the remaining cash would be the total shareholders’ equity. In general, if a company’s D/E ratio is too high, that signals that the company is at risk of financial distress (i.e. at risk of being unable to meet required debt obligations).

Q. What impact does currency have on the debt to equity ratio for multinational companies?

Changes in long-term debt and assets tend to affect the D/E ratio the most because the numbers involved tend to be larger than for short-term debt and short-term assets. If investors want to evaluate a company’s short-term leverage and its ability to meet debt obligations that must be paid over a year or less, they can use other ratios. These balance sheet categories may include items that would not normally be considered debt or equity in the traditional sense of a loan or an asset. Because the ratio can be distorted by retained earnings or losses, intangible assets, and pension plan adjustments, further research is usually needed to understand to what extent a company relies on debt. Company B has $100,000 in debentures, long term liabilities worth $500,000 and $50,000 in short term liabilities. At the same time, the company has $250,000 in shareholder equity, $60,000 in reserves and surplus, and $10,000 in fictitious assets.

Lenders use the D/E figure to assess a loan applicant’s ability to continue making loan payments in the event of a temporary loss of income. If both companies have $1.5 million in shareholder equity, then they both have a D/E ratio of 1. On the surface, the risk from leverage is identical, but in reality, the second company is riskier. To get a clearer picture and facilitate comparisons, analysts and investors will often modify the D/E ratio. They also assess the D/E ratio in the context of short-term leverage ratios, profitability, and growth expectations.

Do you already work with a financial advisor?

- If a company has a low average debt payout, this implies that the company is obtaining financing in the market at a relatively low rate of interest.

- To get a sense of what this means, the figure needs to be placed in context by comparing it to competing companies.

- While a useful metric, there are a few limitations of the debt-to-equity ratio.

- However, if that cash flow were to falter, Restoration Hardware may struggle to pay its debt.

The debt-to-equity ratio is most useful when used to compare direct competitors. If a company’s D/E ratio significantly exceeds those of others in its industry, then its stock could be more risky. As a rule, short-term debt tends to be cheaper than long-term debt and is less sensitive to shifts in interest rates, meaning that the second company’s interest expense and cost of capital are likely higher. If interest rates are higher when the long-term debt comes due and needs to be refinanced, then interest expense will rise. However, such a low debt to equity ratio also shows that Company C is not taking advantage of the benefits of financial leverage.

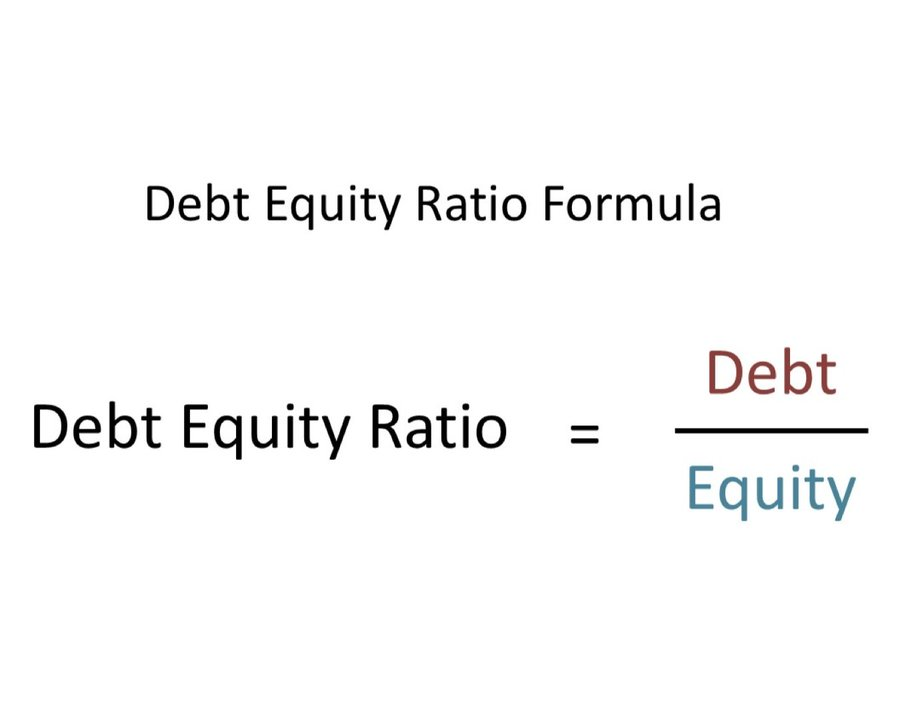

A higher debt to equity ratio indicates that more creditor financing (bank loans) is used than investor financing (shareholders). The debt-to-equity ratio is one of several metrics that investors can use to evaluate individual stocks. At its simplest, the debt-to-equity ratio is a quick way to assess a company’s total liabilities vs. total shareholder equity, to gauge the company’s reliance on debt.

They include long-term notes payable, lines of credit, bonds, deferred tax liabilities, loans, debentures, pension obligations, and so on. « In the world of stock and bond investing, there is no single metric that tells the entire story of a potential investment, » Fiorica says. « While debt-to-equity ratios are a useful summary of a firm’s use of financial leverage, it is not the only signal for equity analysts to focus on. » « Once bond principal and interest payments are made, the leftover profits are retained by shareholders and can be paid out in the form of dividends or buybacks, » Fiorica says.

This looks at the total liabilities of a company in comparison to its total assets. On the surface, this may sound like the debt ratio formula is the same as the debt-to-equity ratio formula. However, the total debt ratio formula includes short-term assets and liabilities as part of the equation, which the debt-to-equity ratio discounts. Also, this ratio looks specifically at calculating profitability ratios how much of a company’s assets are financed with debt. When using a real-world debt to equity ratio formula, you’ll probably be able to find figures for both total liabilities and shareholder equity on a company’s balance sheet. Publicly traded companies will usually share their balance sheet along with their regular filings with the Securities and Exchange Commission (SEC).